Blog: The Problem with Academic Scholarships

Abby Miller, ASA Partner

Today, more than ever, the need for low-income, historically marginalized students to enroll in higher education – and the barriers preventing them from doing so – have been brought to national attention. Amidst a pandemic that disproportionately affected the lives of disadvantaged populations, a call for higher education institutions to increase their equity, and a growing concern about FAFSA accessibility, we must examine the existing institutional resources available to help low-income students access higher education – how they are currently being used, and how they might be adjusted to maximize access.

Specifically, we must examine the true intention and outcomes of merit-based scholarships. Are these institutional academic scholarships rewarding high-achieving students simply to boost a college’s traditional rankings? What if institutions shifted these dollars to students who really need financial assistance?

I was recently watching a certain reality show (don’t judge me, it’s my pandemic comfort!) which I normally find to be an amusing glimpse into the lives of one-percenters. However, I was so disgusted by a character’s total lack of awareness when she announced, in her new $12 million home, that her debutante daughter received a partial scholarship to a private university that I vowed never to watch the show again. This announcement came after the mom offered to lend her daughter a $5,000 designer jacket to take with her to college (which, thankfully, the daughter, who seems to want a break from the wealthy, conservative suburb in which she was raised, declined).

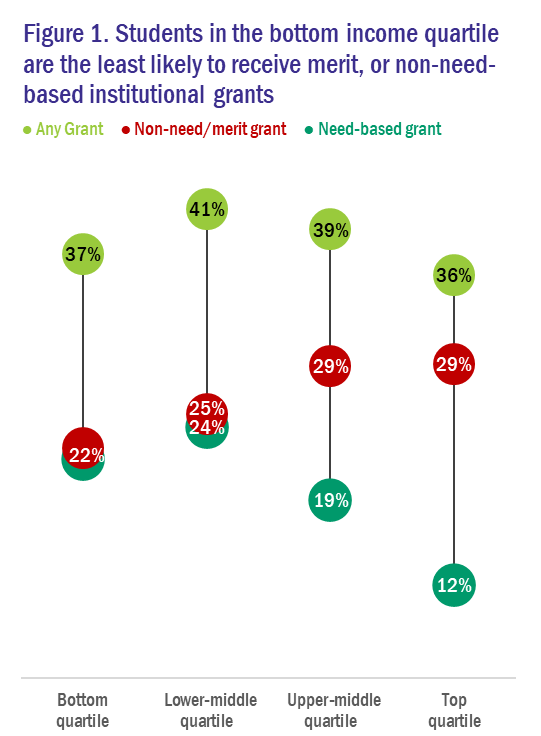

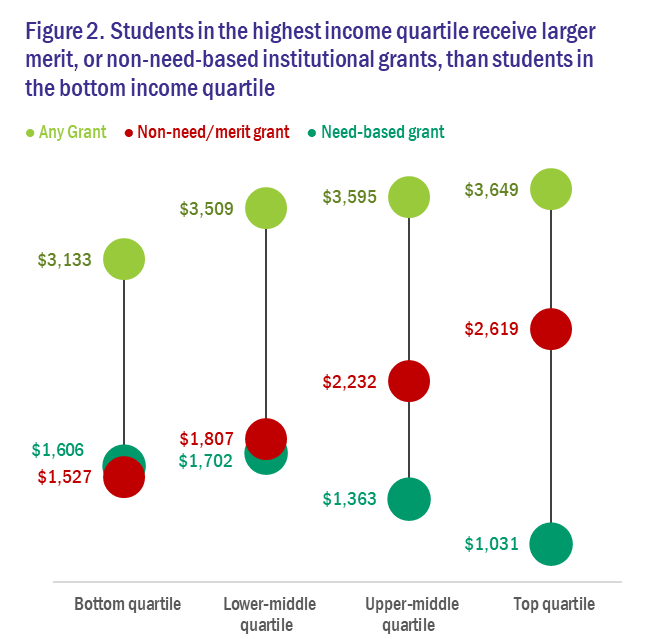

It turns out this scenario is not an anomaly. A look at national data shows us that students in the highest income quartile are more likely than their lower-income peers to receive merit, or non-need-based institutional grants, and at higher amounts (see figures 1-2).

Source: U.S. Department of Education, National Center for Education Statistics, 2015-16 National Postsecondary Student Aid Study (NPSAS:16).

Note: this analysis focuses on merit-based scholarships at four-year institutions where they are most common.

Source: U.S. Department of Education, National Center for Education Statistics, 2015-16 National Postsecondary Student Aid Study (NPSAS:16).

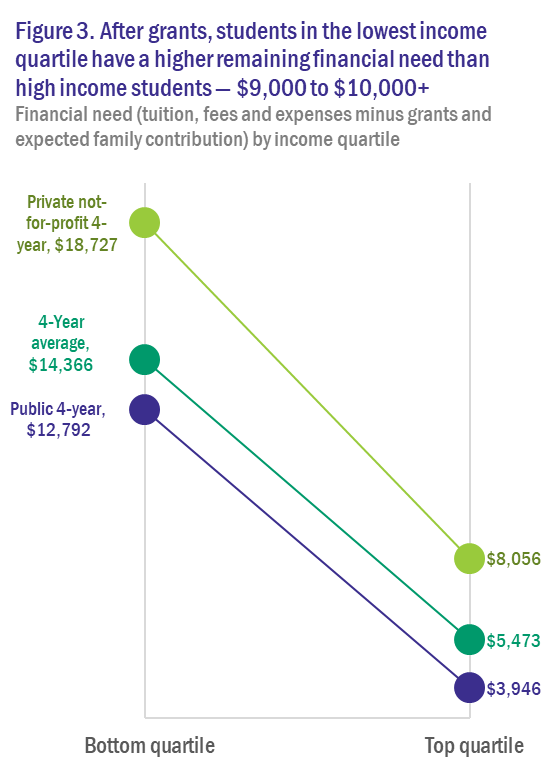

While one might say those students in the bottom quartile do not need institutional grants because they receive federal aid such as Pell grants, figure 3 shows these students still have a higher remaining average need – budget minus grants – than other students (defined as the total budget – tuition, fees, and other college expenses – minus grants and expected family contribution, or the amount a family is able to pay). The remaining need for students in the lowest income quartile averages over $14,000 per year after grants from all sources (institutional, federal, state, private) are taken into account. These neediest students will need to pay the remainder through loans and/or jobs, as their families do not have sufficient sources of income to cover the amount.

Source: U.S. Department of Education, National Center for Education Statistics, 2015-16 National Postsecondary Student Aid Study (NPSAS:16).

The concentration of academic scholarships among higher-income students is a serious problem. The more scholarship dollars that go to wealthy students, the less available for the low-income and middle-class students who really need it. Academic scholarships – or those not based on need – may seem good in theory: reward students who worked hard to get into the college. However, low-income students face insurmountable challenges to college access that those from wealthy suburbs cannot even begin to imagine.

Students from low-income families – in many cases, students of color – face both financial and academic challenges. They typically attend K12 schools in underfunded school districts with a higher student to counselor ratios, lack of college and standardized testing guidance and tutoring, and less access to college preparatory coursework (see related ASA studies ). For these students to apply, be accepted to, and afford college takes not only hard work and perseverance, but also luck. Sometimes it is a chance encounter with a mentor who takes them on, or the recommendation for a college access program that a friend mentions in passing.

To put in perspective how much scholarship money a low-income student needs to afford college, the Pell Grant covers just under one-third of tuition and fees at a four-year, public college. This leaves, on average, over $15,000 a year to cover, for students whose families lack savings and often live paycheck to paycheck, not including supplies, transportation, and other expenses. Sometimes there are state need-based grant programs, sometimes institutions’ endowments allow for need-based scholarships, oftentimes low-income students rely on loans they are stuck paying back their entire lives. All too often, low-income students work while enrolled, enroll part-time, and drop out due to work, family, and financial demands.

While past research has shown that merit-based scholarships primarily benefit wealthier students (see Heller 2006, Price 2001), the topic of institutional financial aid often takes a backseat to the federal aid conversation. Certainly, Pell increases are important, but still not enough, particularly today when the wealth divide continues to grow and disadvantages to low-income students enrolling in college have been exacerbated by COVID.

Institutions need to take a good hard look at the sources available to cover scholarships and their priorities. Do they want to make higher education more affordable and accessible to students who may be the first in their families to attend college, and who want to better the lives of their families? Do they want to serve as engines of economic equality and mobility, and increase the representation of historically underserved students? Or is it more important to reward high achievers and increase their rankings, no matter how much help the applicant does or doesn’t need to pay for college?

Perhaps the solution is to take need into account when awarding merit aid, and to adjust the individual amount based on a student’s remaining need. Certainly, this is a complex topic that requires stakeholders and policies at all levels – institutional, state, and federal – to make systematic changes. But it seems our priorities must be shifted when the wealthiest Americans receive more institutional scholarship money than those with the most financial need.

Sue Clery and Gigi Jones contributed to this blog.